The Best Construction Profit Margin: 5 Ways You’re Losing Money and How to Fix It

"Hey, while you're here, can you just…"

As a professional remodeler, you've undoubtedly heard that phrase a million times before from clients as you're hard at work remodeling their home.

Whether it's a kitchen remodel, bathroom, or a basement you're working on, homeowners often think that just because "you're already there," it's okay to keep interrupting you to do little tasks on the side, without any consequence to the actual job you're there to perform.

Because, after all, from their perspective, you're already in their house, and you've got the tools with you to do the job. So why not just do it?

Because that's not what they hired you to do. And because your time is valuable.

Whenever you step away from the original project you were hired for in order to install a light fixture they picked up at Home Depot, fix a leaky faucet, or stop a door from squeaking, you're spending time doing something you aren't being paid for.

You're not earning money for that task, and it's taking you away from a task that does generate revenue. And in the long run, that's going to cost you plenty.

Extra Tasks Eat Profits

Being profitable as a remodeler means ensuring that all of your on-site client work generates revenue, and that you aren't leaving money on the table by doing unpaid work simply because a client requests it. No matter how small the request is, these extra tasks quietly erode your profit margin.

If you're constantly saying yes to those "oh, while you're here, can you just…" requests, or if you're not properly charging for the time you spend researching and pricing out changes that clients make mid-construction, it's time to take a hard look at how those tasks are impacting your profitability. You need systems in place to stop that money from bleeding out of your construction business.

Five Ways You’re Bleeding Money

Now that you understand how small, unpaid tasks can drain profits, let’s look at the broader picture. Even with careful planning, there are common ways residential construction companies lose money on every project. Recognizing these pitfalls is the first step to taking control of your construction profit margin.

1. Start Charging for Your Time to Price Out “Extras”

Whenever a client asks you how much it would cost to add another electrical outlet or change the vanity they chose for the bathroom, you need to spend time researching and pricing it out. But what if the client decides not to proceed with that request? That's billable time you've spent on a task that you aren't being paid for - and should be.

How to Do It: Add a clause to your contract that provides you with an administrative fee (e.g., $100, $150, $200) to cover the cost of any change requests to construction projects. This will help you recoup payment for the time spent pricing out items that a client doesn't select. This is more important in fixed cost versus cost plus, but a good clause either way.

2. Stop Doing the “While You’re Here” Tasks

It takes time and money to complete every task - even the "this should only take a few minutes" ones. The key difference between these tasks and the ones you've been hired to do is that they aren't accounted for in the price you charge your clients. Time spent on tasks outside your original SOW is billable time that could be charged to another client.

How to Do It: When your client requests additional work, treat it as such. Maintain a running list of all extra tasks requested and price them accordingly. Then, approach them with a cost to complete each item, and only proceed if they approve the change order.

This way, you achieve two things:

1) You manage your time more efficiently by bulking those tasks together.

2) You get compensated for that work.

3. Adjust Your Pricing for Increases in Costs

Material prices fluctuate constantly, and the price you quoted a client for tiles, soft lumber, or even paint might change dramatically during the period between estimating and when construction begins. That's a cost you, the general contractor, shouldn't have to absorb but should be passing along to your client (in the form of a change order).

How To Do It: Put an Escalation Clause in your contract. An escalation clause covers the increases above X% to handle volatile market conditions, just like those we saw during the pandemic.

4. Stop Competing on Price

Being a successful remodeler means taking the right jobs - and ensuring you're charging clients enough to be profitable and cover the unforeseen issues that always arise on a job site. When we compete on price, we stop charging based on our years of experience and start charging just to "win the job." However, by doing so, you're losing out on the opportunity to charge what the job is worth.

How To Do It: Many businesses in the residential construction industry won't make it to their 10th anniversary. To get there, you need to know your numbers and be battle-ready to present clients with the price you need to charge to be profitable.

5. Don’t Allow Clients to Purchase Materials

There are several reasons why clients shouldn't purchase materials, such as being unable to control the quality or provide a warranty. Still, the biggest one by far is the lost profit on materials you didn't purchase. When a client requests to purchase tiles, flooring, or fixtures, you still need to spend time overseeing and managing those materials, but without being able to charge a markup to cover the time spent.

How To Do It: Update your contract to reflect that you purchase all materials and supply all the trade partners for your projects. Then ensure you have that conversation with prospective clients early and often in the sales process, so they are 100% clear about it.

Understanding Your Construction Profit Margin Before It’s Too Late

Many remodelers think they’re profitable until they calculate the actual margins on every project. Understanding your construction profit margin is crucial to determining whether your business is healthy or quietly losing money.

Start by separating gross profit margin and net profit margin.

Gross Profit

This is what’s left after you pay for labor, materials, and trades – i.e., project-related expenses.

Net Profit

This includes overhead costs such as insurance, office rent, and other non-project-related expenses.

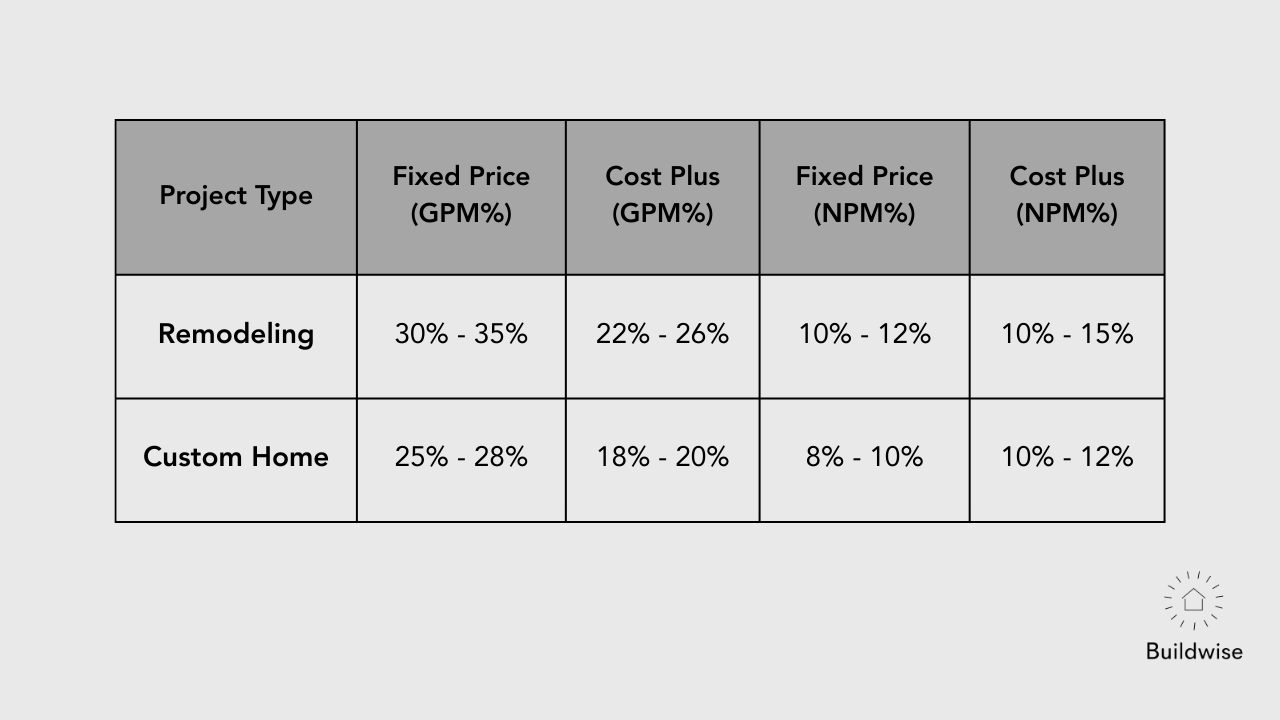

Confusing these can make your business’s financials look healthier than they really are. Typical ranges for both gross and net profit vary by project type, company revenue, and billing model (i.e., fixed-price vs. cost-plus).

In general, remodeling projects tend to have a higher gross profit margin compared to custom home building, as the latter benefits from economies of scale.

Here are the typical ranges for overall GPM and NPM for remodeling and custom home-building businesses.

Even small pricing mistakes can have a huge cumulative effect. Underestimating labor by just five percent on every job could result in tens of thousands of dollars in annual costs.

To protect your margins, track both project-related and non-project-related construction costs. Tracking direct costs like labor, materials, and subcontractor costs will help you see the profitability of each project. Tracking the indirect costs, such as overhead, enables you to determine the margin your business needs to cover overhead and achieve a net profit. If you need help figuring out a repeatable system for how to nail your pricing, then click below to book time to speak with me.

The Hidden Costs Killing Your Construction Profit Margin

The biggest hits to your profit often come from places you don’t even notice. It is not the work you planned that kills your margin; it is all the extra time, small tasks, and costs you don’t track or charge for. These hidden expenses show up on every job, whether it is a fixed-cost job or a cost-plus contract, and if you are not paying attention, they quietly eat into your profits.

Here are five ways these hidden costs can quietly eat into your profit.

Underpricing Jobs To Win Work

It’s tempting to shave your price just to land the project, especially when you want to keep your crew busy. The problem is that underpricing means you’re not covering your overhead, which in turn discounts your net profit. Pricing based on your real numbers and past experience keeps you profitable, even if it means walking away from someone who only shops on price.

Inaccurate Labor Cost Tracking

It is not just your crew’s time on the tools that matters; your time counts too. Every site meeting, client call, supply run, and bit of job-site admin adds up.

The bigger problem arises when you lack an automatic system to track the hours logged by you and your team, providing real-time labor costing information. If you’re not using software to track this, you have no clear picture of what a job is actually costing.

Buildwise shows you the number of hours spent on a job in real time so you can make adjustments and improve your estimating for tomorrow's jobs with today's information.

Not Enforcing Change Orders

Change orders happen on almost every project. They might come from the client, or from things beyond your control, like hidden site conditions, updated drawings, code changes, or supply chain delays.

If work falls outside the original agreement, it must be documented and billed. Skipping this step means you’re giving away labor and materials. Even small changes add up over a project, cutting into your profit.

For fixed-price jobs, unbilled changes directly cut into your margin. On cost-plus projects, failing to track changes can make it more difficult to bill the client accurately, potentially leading to disputes or delays.

Enforcing change orders isn’t about being difficult; it’s about protecting your business. Clear documentation keeps clients informed, keeps your team on the same page, and protects your profit.

Material Price Fluctuations

Material costs can change daily. Lumber, drywall, tile, concrete, roofing, and other basics can jump between the time you bid a job and when you actually order. If your contract doesn’t address these changes, or if you just absorb the difference, your profit disappears faster than you realize.

As a fixed-price builder, you feel this immediately because every increase comes straight out of your margin. Cost-plus builders offer more flexibility, but it's still crucial to communicate clearly with clients about how price changes are handled. If you don’t, even a small spike can lead to confusion or disputes.

The key is planning ahead with escalation clauses in your contracts. This ensures that material price increases are passed through fairly and protects your margins without creating surprises for the client.

Material prices are always moving. The better you handle these changes in your contract, the less likely they will eat into your profits.

Wasted Time On Extra Tasks

We’ve all been there. A client asks, “Can you install this light fixture?” or “While you’re here, can you put up this shelf?” If you keep saying yes without billing for it, those small tasks pile up.

One or two unpaid extras might not feel like much, but across a job they can add days of work you’ll never recover. You need to protect your margin by treating those extras like what they are: billable work.

The solution is straightforward: if you plan to perform tasks outside the agreed-upon scope of work, you must track and charge for them. Most importantly, you need to set the right expectations upfront in your pre-construction process so homeowners know that every additional “while you’re here…” comes with a price tag.

How to Price Your Remodeling & Custom Home Projects for Maximum Profit

Pricing your work is one of the biggest challenges of running a remodeling or custom home-building business. A small mistake, even just a few percentage points, can cost you tens of thousands of dollars over the course of a year.

1. Determine Your Billing Model

Decide whether the project will be fixed-cost or cost-plus. This choice affects how you set your price and protect your profit.

For fixed-cost jobs, you take on the risk for labor and materials. Your price needs to cover all costs and include enough margin to protect your profit if expenses increase or the project takes longer than expected.

For cost-plus jobs, the client covers actual labor, material, and trade costs, so the focus is on setting a clear markup that achieves your profit goals while keeping billing transparent and easy to track.

Understanding your billing model upfront makes the rest of the pricing process more accurate and ensures your approach matches the type of job you are doing.

2. Know Your Target Margin

Before setting a price, you need to determine the margin you need to earn. Margin is the portion of the project price that actually becomes profit after all labor, materials, and overhead are paid.

It’s easy to confuse markup and margin. Markup is the percentage you add to your costs to set a price. Margin is what you keep as profit. For example:

A project costs $100,000 in labor, materials, and trade costs.

You apply a 25% markup. That adds $25,000, so the selling price is $125,000.

Your profit is $25,000, which is 20% of the selling price—not 25%.

Here’s the math: $25,000 / ($100,000 + $25,000) = 20%

Understanding this difference helps you price projects accurately. For fixed-cost jobs, you carry the risk for project costs, so your margin needs to be high enough to protect your profit if costs rise or the job takes longer than expected.

For cost-plus jobs, the client covers actual costs, so your margin comes from the markup. Knowing your target margin ensures your profits stay predictable and your pricing stays intentional.

3. Price Labor Correctly According to Labor Burden

To price your labor costs accurately, don’t just consider their wages. You also need to factor in payroll taxes, insurance, benefits, and other employment expenses. This provides you with a comprehensive view of the actual cost of each hour of your team’s work.

Next, account for your project management time, as it is a job cost that needs to be included in your estimates—not as part of your markup. Every call, site visit, client update, and coordination with trades should be tracked and billed like any other labor..

By combining your costs with your team’s, you can determine the true labor cost for the project. This number is the foundation for pricing jobs accurately and keeping them profitable.

4. Do Pre-Construction and Build Proper Estimates

Pre-construction is the planning phase before any work starts. It involves reviewing the project scope, gathering bids from subcontractors, calculating material and equipment needs, and identifying all costs. This step ensures you have a clear understanding of what the job will require.

Once you have all the details in place, you can create a thorough estimate. A detailed estimate provides a clear picture of the total project cost and helps you effectively communicate with clients about the scope and value of the work. It also makes managing the project easier, keeps budgets on track, and protects your profit.

Taking the time to plan and estimate properly sets every project up for financial success and reduces surprises once construction begins.

By following this four-step process, you create a clear framework for pricing every project. Knowing your billing model, setting the right margin, accounting for all labor, and building detailed estimates ensures your prices protect your profit and reflect the value you provide.

When each job is priced accurately from the start, you reduce risk, manage costs effectively, and set your business up for long-term financial success.

Build a High-Profit Remodeling Business with the Right Clients

Not all clients contribute positively to your bottom line. Low-value clients who constantly bargain, push for extra work, or pressure you to cut corners drain your profit margin. High-value clients respect your expertise, understand the importance of pre-construction planning, and are willing to pay for quality.

To attract profitable clients, start by setting expectations early. Discuss budgets, explain how change orders work, and clarify that your company manages materials and trades to ensure quality and timelines. Learn to recognize high-value clients: they prioritize quality over cost, trust your recommendations, and understand that construction involves detailed planning and occasional adjustments.

Turning down clients who don’t meet these criteria may feel uncomfortable, but it is one of the most effective ways to protect your profit margin. Over time, focusing on the right clients reduces stress, prevents margin erosion, and allows you to take on projects that contribute positively to your business’s bottom line.

Using Financial Tracking Software to Maximize Your Profit Margins

Pricing a job accurately is the first step, but protecting that profit during the build is just as important. One of the biggest risks is losing track of costs once the work begins. Labor hours, trade invoices, and material purchases can all slip through the cracks if you’re relying on manual tracking. Even small misses add up quickly and erode your margin.

Tracking all project costs in one place gives you a clear picture of how the job is performing and helps protect your profit in real time. You can see trends, compare actual costs to estimates, and make adjustments before small issues become big problems.

That’s where financial tracking software like Buildwise makes a real difference. Buildwise brings every labor entry, material receipt, and trade invoice into one system—organized as you go—so you have an up-to-date view of each project’s costs versus your estimate.

With that clarity, you can spot cost overruns early, make informed decisions, and maintain consistent profit on every job.

The Bottom Line on Protecting Your Construction Profit

Profit in remodeling and custom home projects isn’t just about what you charge—it’s about knowing where your money is going and stopping leaks before they erode your margins. Small, unpaid tasks, scope changes, material price increases, and low-value clients can quietly chip away at your bottom line if you’re not careful. Recognizing these common pitfalls and implementing systems to manage them is key to maintaining profitability.

Using financial tracking software enables you to view all project costs in one place, monitor performance, and make informed decisions to protect your profit.

Tools like Buildwise help you capture labor hours, material purchases, and trade invoices in one system, providing clear visibility into each project and ensuring every job stays profitable. Without this kind of oversight, hidden costs can accumulate, minor errors can become major losses, and your hard-earned margins may slip away quietly.