QuickBooks for Contractors

In order to know if you’re running a profitable residential construction business, you need to have a reliable accounting system in place. One that can track all your company’s financial data and ensure you manage compliance accounting accurately. The most commonly used accounting software by contractors in the construction industry is QuickBooks.

It’s most often the program of choice for construction companies because of its immense popularity, ease of online use, and ability to interface with other construction management software. And while it’s not necessarily tailor-made for general contractors, it is a solid accounting program that you and your accountant or bookkeeper can access simultaneously.

Desktop iterations of QuickBooks (QuickBooks Desktop) included a version specifically made for the construction industry. As of the writing of this article, the desktop version is no longer available to new users but is still being supported for existing subscribers. That leaves QuickBooks Online (QBO) as the only choice for contractors starting with a new construction accounting system. While the online version offers much more accessibility, it does lack some of the specific functionalities that the desktop contractor edition, QuickBooks for General Contractors, provided.

Choosing any software for your business is a big decision, especially one that tracks financial data, because that’s your lifeline to how well your business is performing. This article will help break down the QuickBooks features that general contractors can rely on, the positives and negatives of using the program, and how it compares to construction-specific software.

What Is QuickBooks?

QuickBooks is a widely used accounting tool for general contractors. It helps them manage the financial side of their business by supporting essential functions like expense management, invoicing, payroll, and general financial tracking.

Overall, it's a great starting point for many builders, especially those who use a fixed-cost pricing model. However, it does have some limitations, especially when it comes to detailed job costing and cost-plus billing, which is why it works best in tandem with construction-specific management software.

For cost-plus jobs, QuickBooks offers a “billable expense” feature that lets you manually add each billable item to an invoice. However, it lists these expenses in a long, unorganized format—similar to a grocery receipt. This can make the invoice confusing and hard for clients to understand. This is because cost-plus invoices should be grouped by major cost of goods categories like labor, materials, and trades. However, QuickBooks doesn’t support this structure out of the box, so contractors who need clean, organized cost-plus billing often look for external workarounds like spreadsheets outside of QuickBooks.

Because QuickBooks isn’t purpose-built for detailed job costing, builders often need to export information from QuickBooks into Excel and manually manipulate it to get the answers they need. That extra step takes time and effort that many contractors don’t have, so they end up skipping it. As a result, QuickBooks is not a completely reliable source for project financial clarity.

Key Features of QuickBooks

QuickBooks offers several features to support your residential construction company’s financial tracking needs.

Here are five essential components:

1. Expense Tracking

One great feature of QuickBooks for managing finances is the ability to link bank accounts, categorize costs, and track receipts. By connecting your accounts, you can easily see and reconcile project-related and overhead expenses in one place. This makes it much easier for your bookkeeper to match up transactions and keep your records accurate. However, your bookkeeper will still need access to monthly statements from your bank, as QBO does not download the statements directly from your bank.

Additionally, while this feature helps to ensure costs aren’t missed, your bookkeeper needs the backup documentation to understand what project and cost code the expense is for. It creates a tremendous amount of back-and-forth with Excel sheet exports and emails, slowing down the accounting process.

This is where Buildwise, a front-end for receipt and trade invoice management, comes in. With Buildwise, you and your team enter receipts, ensuring they are tagged to the corresponding project and cost code. Then, you or your bookkeeper pushes them to QBO. With all of the required information, you can save immense time and money on the backend of running your business.

2. Invoicing and Payments

The invoicing and payments feature in QuickBooks allows you to send invoices and collect payments online.

For cost-plus remodelers, QBO has a billable expense invoicing system that they can use to ensure that all expenses and bills are added to invoices, so you don’t miss billing for something. However, that doesn’t cover the labor expended on the project during the billing period, a manual entry process prone to error.

If you’re a fixed-cost builder, QBO offers you three ways to create invoices if you’ve entered your estimate into QBO:

Percentage or amount in dollars for any item within your estimate

Percentage of the entire estimate across all items

An ad hoc or random amount of the remaining un-invoiced estimate amount

If you do not enter your estimates into QBO, then you can invoice any amount you would like in their free-form invoice editor. You can also schedule invoicing based on a recurring set amount and cadence.

3. Payroll Management

QuickBooks has a payroll management feature—available at an extra monthly cost—that can process and fully manage employee payroll. This portion handles the compliance side of paying your employees, including payroll taxes, employer matching pension, unemployment insurance, etc.

You can assign each employee within your QBO payroll module to either Cost of Goods Sold (COGs) or “Expenses” (aka Overhead), but you can’t easily split time between the two.

This is where a system like Buildwise comes in, as we allow you to allocate time tracking in individual hour increments to each project that someone performs. And if that someone works on both sides of the business–projects and overhead–then you’ll have accurate information about how profitable your projects are.

4. Financial Reports

QuickBooks can generate profit and loss statements, balance sheets, and tax reports. Its reporting features have improved, especially in some U.S. versions, which allow for customizable reports. However, the system still struggles to provide detailed project-level job costing efficiently above and beyond a project-level profit-and-loss report. Because of these challenges, most construction professionals struggle to use it effectively and instead depend on tools like Buildwise for accurate estimating, cost coding labor and expenses, and job cost reporting.

5. Job Costing

While there is no specific “Job Costing” feature in QBO, you can achieve job costing in several different ways. “Projects” is a feature within QuickBooks Online that allows you to set up a “sub-customer” for each “customer”. This means that all of the financial information for their project is in one container. If you do multiple jobs for each customer, then the financials are separate.

Using Projects, you can tag material and trade expenses to them, and you can also have team members assign their time to them if you’re using QB Workforce (formerly QB Time, T-Sheets).

Using the project's feature allows you to see profitability reports, which are effectively a profit and loss statement by project.

A profit and loss statement will show you:

Revenue collected

Cost of goods:

Labor

Materials

Trades

Other costs (brokerage fees, disposal, equipment rental, photocopies, etc)

Gross profit: typically displayed as a percentage of revenue

Overhead: typically, there isn’t anything in this section on a project-level P&L

Net profit: typically matches the gross profit as there are no overhead expenses in a project-level P&L.

If you’re interested in learning more about profit and loss statements, sign up for Buildwise, where you’ll gain access to our coaching program on financials.

However, job costing doesn’t stop at the project profit and loss. It is more effective for breaking down costs by the different cost codes or functional areas of a project, such as demolition, framing, etc. In QBO, you can achieve job costing by using either products/services or class tracking. There are pros and cons to both approaches, but overall, most builders find this system to be bulky. It also isn’t easily accessible information for their Project Managers who don’t have access to the system. This is why many look for a complementary program to manage their project financials, like Buildwise.

Otherwise, they have to export this data to Excel and manipulate it, which is a manual, tedious, and error-prone process. If you’re ready to stop the manual work, then start your free trial of Buildwise now.

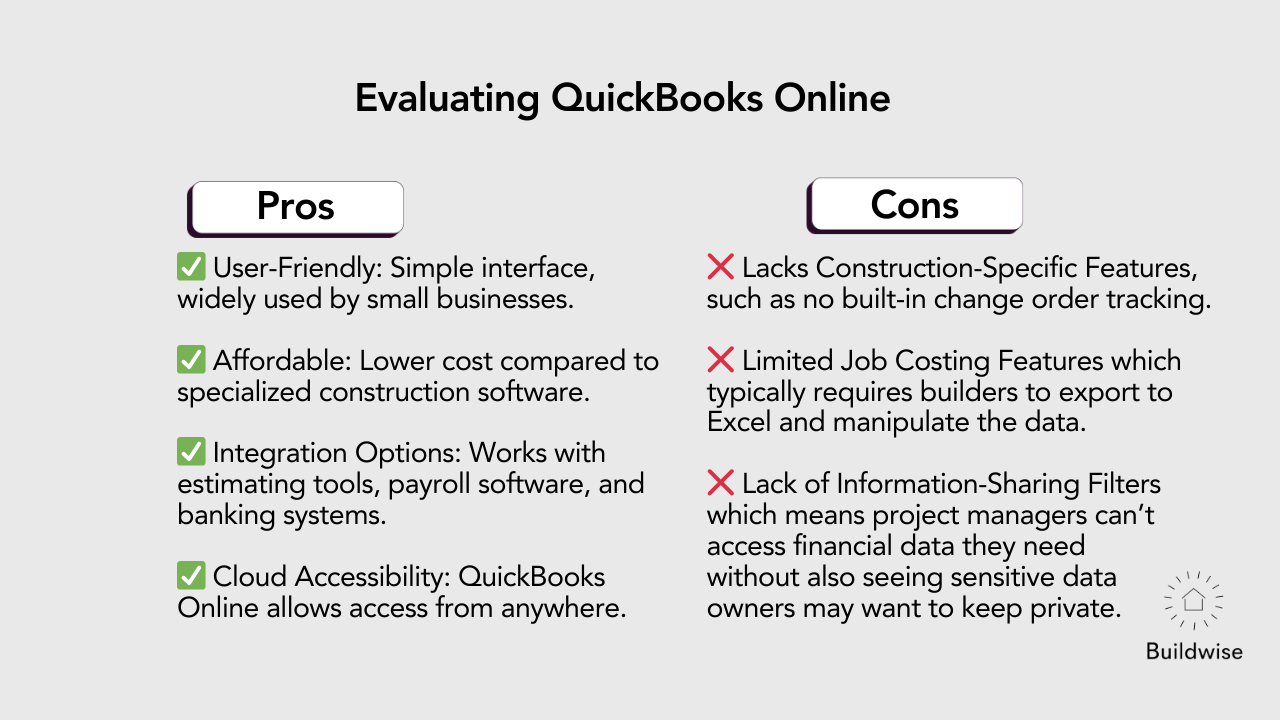

Pros and Cons of QuickBooks

Like most software programs, QuickBooks Online comes with both positives and negatives. Let’s review the pros and cons of QuickBooks Online:

How to Use QuickBooks

To begin using QuickBooks Online effectively, general contractors should follow a step-by-step setup process that ensures their accounts, projects, and reports are organized correctly from the beginning.

If you want this done for you, sign up for the Build and Profit Academy. We’ll set up your QBO file and provide you with one-on-one support to learn how to use the system and connect to your Buildwise account.

Let’s outline those steps below:

Step 1: Set Up Your Chart of Accounts

First, you will want to organize your income and expense categories based on job types and set up your chart of accounts. The default version included in QuickBooks Online isn’t programmed well for general contracting businesses, so you should consider working with a coach or financial professional who understands the residential construction industry and can help you set this up.

Step 2: Link your bank and credit card accounts

The second step is to log in to your bank through QuickBooks Online and link your bank and credit card accounts. This will upload historical bank transactions, but it’s important to note that every issuing bank has different limitations on how far back they will provide this data. So you might need to import CSV files of older transactions. If you need help with this, join the Build and Profit Academy, where we’ll ensure that everything is loaded into the system accurately.

Step 3: Track Job Costs

A project is essentially a sub-customer of a main customer in QuickBooks Online. This setup allows you to track expenses and income at the project level, giving you a clearer picture of job performance. If you're on the Plus plan or higher, you can activate the "Projects" feature to tag expenses directly to each project.

To track costs by cost codes, you can use either the “Products and Services” list or the “Class Tracking” feature—just one or the other, typically not both. Remember that this method works best for tracking materials and trade partners. Labor costs are often not broken down by cost code due to limitations in how payroll data integrates with accounting systems.

Buildwise is the only software that forces team members to sort their time at the end of the day into the corresponding cost codes in a simplistic method, ensuring you have an accurate job costing picture.

Step 4: Manage Invoicing & Payments

Access the system settings to set up your invoicing template preferences. Then you can build invoices to send to your clients for payment. Depending on which QBO plan you’re using, you can also activate payments. For ACH or Automated Clearing House payments, QuickBooks charges a fee, which varies by region but is typically around 1%. If accepting payments via an alternate method, include those details on your invoice.

If you schedule progress billing at a specific amount and cadence, you can set QBO up to automatically generate and send invoices to your clients. This works well for fixed cost builders who know how much they are billing and can predict either a percentage or a fixed amount on a specific cadence. For more on how to invoice fixed-cost projects click here.

If you’re a cost-plus builder, your billing schedule and amounts aren’t predictable in advance, so you’ll need to generate invoices manually. Buildwise, while not yet able to invoice clients directly, is purpose-built for cost-plus construction and streamlines the process to generate proper cost-plus invoices in QuickBooks quickly. With Buildwise, what used to take hours now takes minutes.

Step 5: Integrate with Construction Tools

Buildwise gives you purpose-built tools like estimating, change order management, and expense management so that you can see your estimated to actual costs in real time without going into an accounting system that you don't know how to navigate and isn't purpose-built for construction.

Syncing with QuickBooks lets you use our app to track time, upload receipts and invoices, and streamline the accounting process. Faster accounting cycle times mean fewer questions from your bookkeeper/accountant, saving time and money in your business's backend. This allows you to focus on your estimating and building a more profitable business.

Best Alternatives to QuickBooks for Contractors

While there are few other options available, two alternatives can be used instead of QuickBooks.

Sage 50 & Sage 100 Contractor

Sage 50 is a desktop-based accounting software designed for small businesses with simpler needs, while Sage 100 Contractor is a construction-specific software aimed at small to mid-sized contractors with more complex project management and accounting requirements. Sage 100 Contractor, formerly known as Sage Master Builder, offers features like estimating, job costing, project management, and payroll, all tailored for the construction industry.

Sage 100 Contractor is a cloud-based solution, while Sage 50 is primarily a desktop application with cloud connectivity. Sage 100 Contractor offers a range of features for construction businesses, including project management, estimating, and job costing, all accessible through a web browser. Sage 50, on the other hand, is designed for small businesses and offers basic accounting functions with the option to access data remotely through cloud connectivity.

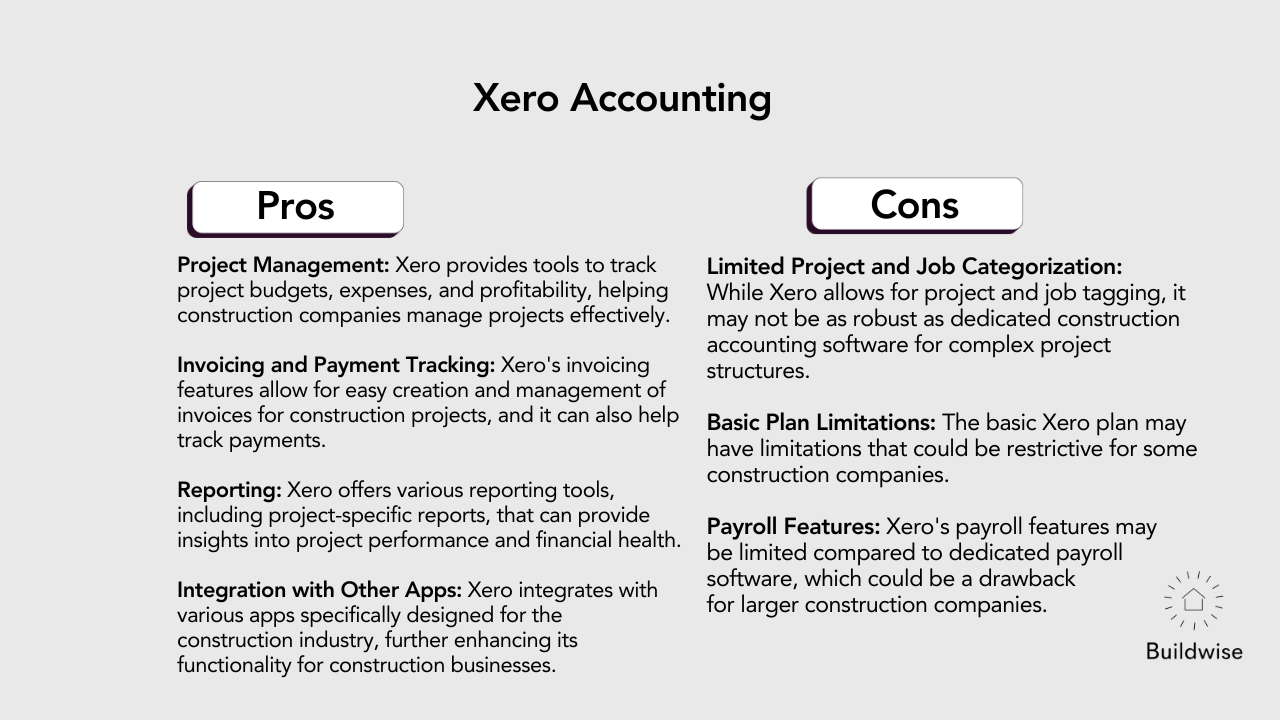

Xero

Xero is a cloud-based accounting software that caters to small businesses and offers features like project management, invoicing, and reporting that can be beneficial for managing construction projects and finances.

Buildwise + QuickBooks – The Perfect Integration

Buildwise is a financial and project management software program that complements QuickBooks in the residential construction industry by simplifying the financial workflow for general contractors, remodelers, and custom home builders. It ensures a streamlined expense management process and real-time job costing information, and saves you time and money in the backend by removing tedious and error-prone manual work.

Buildwise is purpose-built to save builders and remodelers from trying to adapt QuickBooks Online for job costing and exporting data to Excel or Google Sheets. Instead, contractors can fully cost code their projects within Buildwise and then easily push categorized expenses into QuickBooks, keeping the workflow simple.

This integration is key to reducing manual data entry. It avoids the need to enter the same information in your project management software and QuickBooks. It also reduces reconciliation time and errors and ensures your compliance accounting is handled on time.

What Is Buildwise and How Does It Work with QuickBooks?

Buildwise is a web—and mobile-based financial and project management software program designed for fixed-cost and cost-plus remodelers and custom home builders. It helps them organize and understand their financials to run profitable residential construction businesses.

Built from over 5,000 hours of coaching, refined spreadsheets, and a 21-year career in custom home building and remodeling, Buildwise avoids the complexity found in many other tools. It offers contractors exactly what they need: automatic real-time job costing, robust spreadsheet-style estimating and change order tools, and built-in client approval functionality.

Buildwise integrates with QuickBooks by syncing project costs directly, tracking real-time project profitability, and organizing costs to help you invoice from QuickBooks much faster for cost-plus projects.

Key Benefits of Using Buildwise + QuickBooks Together

There are a number of key reasons why Buildwise and QuickBooks Online work well together, and several key benefits to using them in conjunction with each other.

Seamless Job Costing

With Buildwise and QuickBooks, you can track project estimates, change orders, and expenses in one system. This removes having multiple spreadsheets in your Google Drive or Microsoft OneDrive account.

Accurate Profit Margins

Using Buildwise as the front-end to your QBO account, you’ll leverage our powerful and automated job cost reporting to easily manage your project budgets, see your margins in real-time, and push everything downstream to QBO.

Time & Cost Savings

QuickBooks Online isn’t purpose-built for job costing and doesn’t provide builders with complete and accurate job cost information, especially regarding labor costs. As a result, builders do double the work to export information from QuickBooks into Excel and manually manipulate it to get the information they need. Using Buildwise as the front-end for your QBO account lets you solve this problem effortlessly.

Better Financial Visibility

With the combination of detailed job costing from Buildwise and the ease of syncing information with your QuickBooks Online account, you can view automated, accurate reports to improve your estimating, catch extra costs you need to change order, and provide you with project—and company-level financials with one click.

Who Should Use the Buildwise + QuickBooks Integration?

The Buildwise + QuickBooks integration is ideal for general contractors, remodelers, and custom homebuilders who need precise job cost tracking, want to reduce errors in financial reporting, and don’t want to learn complex accounting software. Whether you’re already using QuickBooks but need better tools for estimating, change orders, and job cost reporting, or you haven’t got anything besides some spreadsheets, Buildwise is right for you.

How to Get Started with Buildwise + QuickBooks

You can easily get started with Buildwise + QuickBooks by following three simple steps:

Sign up with Buildwise: You’ll be onboarded in less than 30 minutes, including integrating with your existing QBO account.

Onboarding Call: You can book an onboarding session with Bryan Kaplan to nail your pricing model, ensure everything is clear in your Buildwise account, and build your first estimate in 30 minutes or less.

Get support and training every step of the way: With Buildwise, you are added to our private community where we offer one-on-one support, bi-weekly LIVE Q&As, and where you can book virtual calls with our team whenever needed. We have full online training tutorials and a help desk with instant chat support.

The Bottom Line on QuickBooks for Contractors

QuickBooks Online is a solid accounting solution for general contractors, offering essential features like expense management, invoicing, payments, and payroll management. However, for remodelers and custom home builders, QBO alone may not provide the detailed job costing needed for cost-plus billing. This is why integrating your QuickBooks account with purpose-built construction management software like Buildwise is an important step in ensuring your general contracting business is running profitably.

Buildwise and QuickBooks bridge the gaps left in your financial picture by streamlining the expense management process, reducing errors, and providing real-time insights into project job profitability. Buildwise is designed to fully cost code projects when the expense is entered via our mobile or web apps, and then categorized expenses are pushed into QuickBooks. This eliminates the need for contractors to manually enter the same data in multiple places, significantly reducing the time spent on reconciliation and minimizing costly mistakes, ensuring that project costs are always accurate.

Both Buildwise and QuickBooks are cloud-based, meaning that contractors, project managers, bookkeepers, and accountants can access up-to-date financial data from anywhere, making collaboration easier than ever. When used in tandem, contractors can stay on top of their job costs without relying on complicated workarounds. This allows them to make better informed decisions while saving time, avoiding costly errors, and maintaining a clearer financial picture of their business.